The SECURE Act, or “Setting Every Community Up for Retirement” Act, became law on December 19, 2019. The idea behind this bill is to make retirement savings less complicated, and to simplify the rules of IRAs and other retirement funds.

If you were over the age of 70.5 before the SECURE Act went into effect, the changes laid out here will not affect you. If you turn 70.5 after January 1, 2020 there are a few changes you should be aware of. Namely, the change of your required minimum distribution (RMD) and contribution age.

Changes to RMD and Contribution Ages

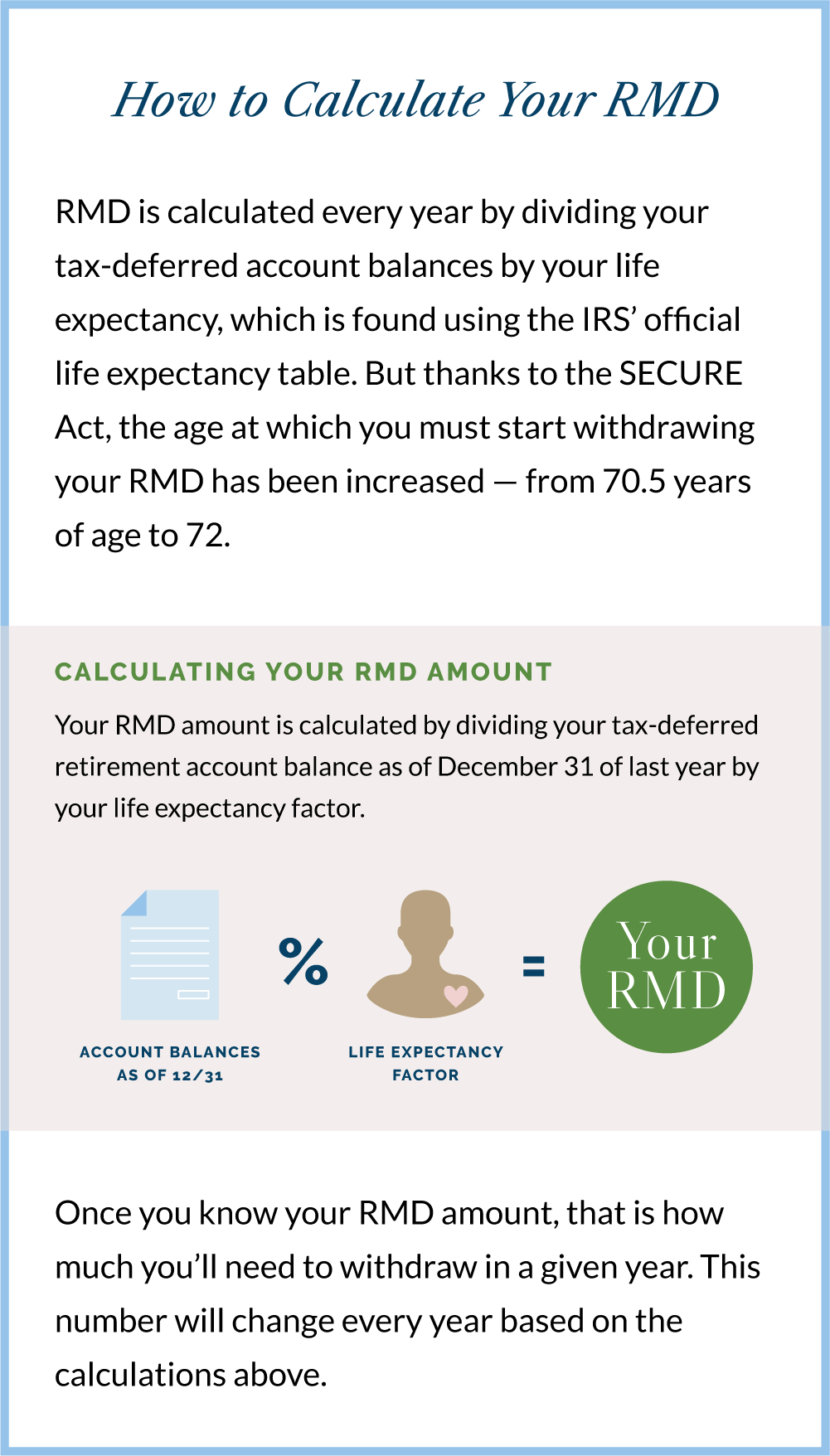

Before the SECURE Act passed, retirees were required to begin drawing minimum distributions from tax-deferred accounts by age 70.5. That age has now been increased to 72. The contribution rules have also changed. It used to be that, after 70.5, you couldn’t contribute to your IRA. Now, as long as you’re working and have earned income, you can contribute to a traditional IRA regardless of age. This is great news for those people who’ve delayed retirement and want to keep working.

For those who turned 70.5 years of age after January 1, 2020, you’ve got about a year and a half before you have to start withdrawing from your tax-deferred accounts. If you’re still working, you can also keep contributing to those accounts.

The Benefits of SECURE Act Changes

Changes to RMD and contribution ages are reflective of our longer life expectancy as a country. The longer we live, the more money we will need in retirement. By pushing back the date when we must start withdrawing from our retirement accounts, the U.S. government has allowed more space for that money to grow for 1.5 more years. Plus, if you decide to continue working well into your 70s, this means you can keep contributing, even as you withdraw those minimum distributions.

This is a great thing because it gives people more time to manage the money they’ve set aside for retirement, and to make sure their retirement accounts and distribution strategies are set up for long-term success. If people stop working at 65, they now have 7 years instead of 5.5 years to figure out their distribution strategies and to let their money grow. However, it can also have its downsides.

The Downsides to SECURE Act Changes

While SECURE Act changes give retirees more time to save and strategize, it can also create more complexity. For example, if you continue working, you will pay taxes on your income plus any Social Security (for those who are 62 and up) and RMD income (for those who are 72 and up). This pushes you into a higher tax bracket altogether, increasing your tax liability as you near retirement.

Plus, without knowing how to take advantage of tax deferment strategies, you won’t be growing your retirement accounts as much as you may want, or in the best ways to avoid tax liability in retirement. Depending on your individual situation and life expectancy, this could cause a potentially larger RMD and a larger tax bill after you turn 72. We don’t want your assets to face tax erosion, which is why it’s important to start planning now for your RMD and official retirement age.

What to Do About SECURE Act Changes to Your Retirement

The main takeaway from all of this? Review your retirement plan, evaluate your tax strategies, and make sure you know how to best leverage your IRAs and other retirement accounts between when you retire and when you turn 72. There are plenty of opportunities to set yourself up for success in retirement from both tax and income standpoints.

If you’d like help creating a plan that helps you make the most of your retirement accounts, distributions, and taxes, the team at Guiding Wealth can help. We help retirees make the most of their retirement through long-life planning.