Retirement is commonly viewed as the end-goal in life. Work hard, save money and someday you’ll be able to sail blissfully into retirement.

While it sounds pretty straight-forward, the experience of actually retiring can be much more difficult than what you may imagine.

Below are tips to help you handle the retirement transition well.

Retire FOR Something Rather Than From Something

Retiring because you are excited about a new phase in life is a lot different than simply retiring because you can’t stand the thought of working another year.

For some people, knowing what they want to retire to is easy and they make the transition well. For the majority of retirees though, it’s challenging to know how they will fill their days.

From a practical standpoint, prepare by starting a list of activities that you would want to do once you retire. It can be easier to create this list while you are still working, rather than waiting until you are suddenly facing those empty days. The activities can be as simple as coffee with friends or as elaborate as touring the world. They may include pursuits as diverse as volunteer work, continuing education, or spending time with grandchildren.

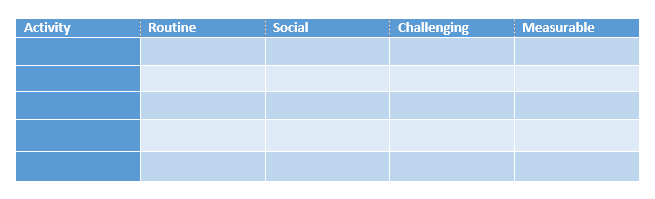

Once you have your list of activities, put them in the chart below. Each of the columns represents an element of fulfillment. Routine means the activity is something scheduled regularly. Social means the activity involves interaction with other people. Challenging refers to learning something new or setting goals. Measurable means there is a way to show progress, achievement, or success.

Answer whether the activity meets the element of fulfillment by writing “yes” or “no” in each of the boxes next to the activity. Every activity may not have every element of fulfillment, but as you approach retirement, your goal is to have at least a couple of activities that will include all four. Research shows that activities that include all four elements produce feelings of well-being and energy.

Have a Retirement Plan

Far too many people retire without a financial plan. Some may not fully understand the technicalities of using their investments for income or even how much money they will need to retire. The fear of not having enough money can be crippling, especially if you know that you aren’t likely to re-enter the work force. Knowledge of your investment strategy can be one of the best ways to reduce money anxiety in retirement.

To retire comfortably, you have to know your numbers. The specific numbers you must know include:

-

How much you spend on a monthly basis

-

How much income you will get from social security and pensions

-

How much money you’ll need every month (or year) from your investments

To get a grasp on these numbers, it’s best to review at least one year’s history of expenses. Your budget will change when you retire, but having a firm knowledge of your numbers going into retirement will prepare you to make informed financial decisions and will bring peace of mind through this transition.

Understand Your Investments

Finally, become acquainted with how your investments work. Seek help from a financial professional if necessary. It’s essential that you know how you are going to get the income you need to retire.

Making the transition from working and having a sense of control over your income to trusting that your investments and savings will provide the income you need, can be difficult. The more you know and understand, the more comfortable you will feel as you make the transition.