Today is Inauguration Day in the U.S., a day when our newly elected president is sworn into office. January 20 has served as Inauguration Day since the 1930s. The ceremony traditionally includes events such as the oaths of office, parades, poetry readings, speeches, and more — though it’s unclear what the 2021 celebrations will look like because of the pandemic.

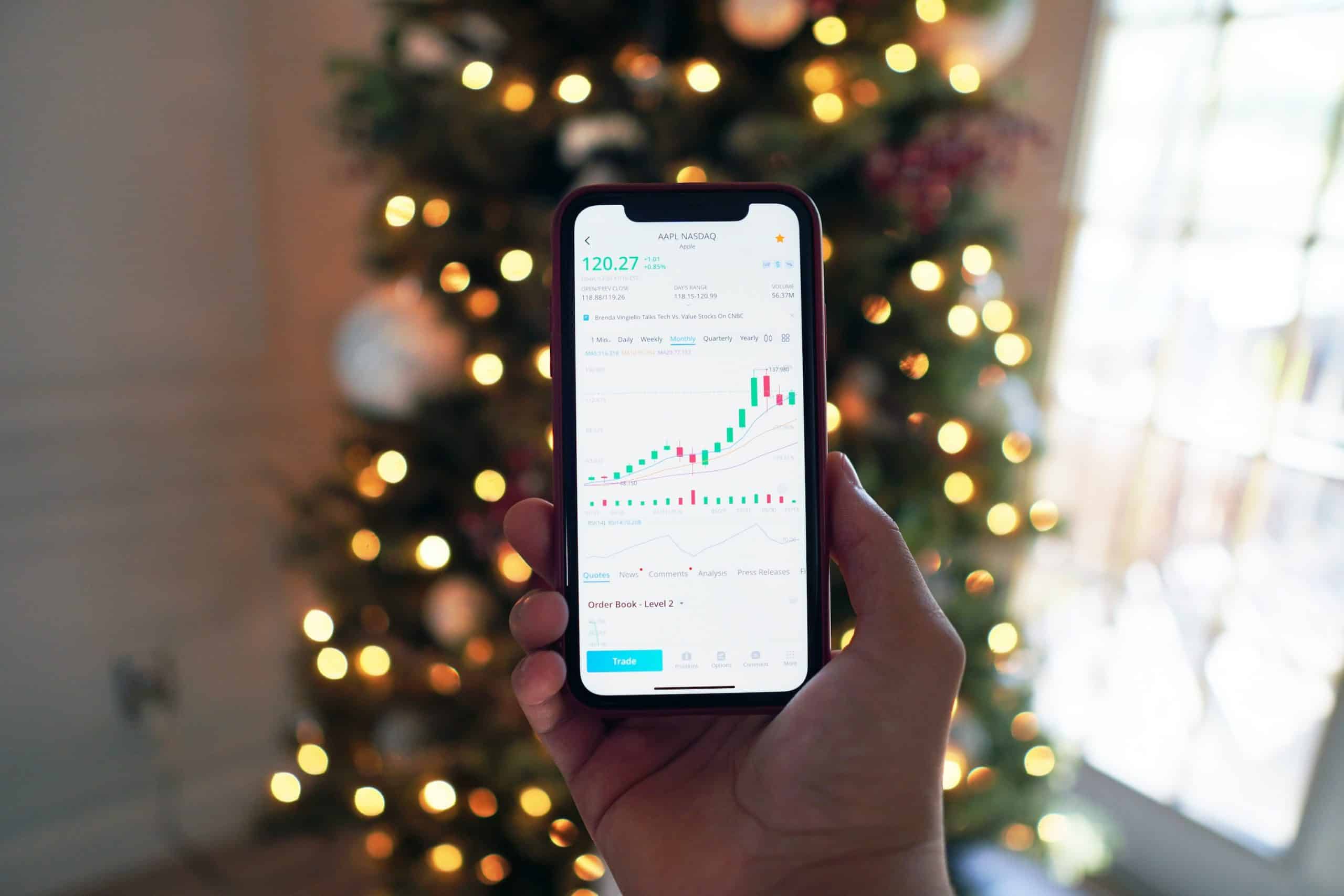

With a new president comes changes in policy and laws. But do presidential elections also affect the stock market? Can you expect to make changes to your investment strategy following Inauguration Day?

We take a look at some myths about the relationship between presidential elections and the stock market, plus what it means for your investments below.

Stock Market Performance Over a Four-Year Term

The Presidential Election Cycle Theory, developed by Yale Hirsch, founder of Stock Trader’s Almanac, suggests that the stock market follows a pattern during a new U.S. president’s term. Hirsch’s theory suggests that stock markets are weak in the first year, recover in the second year, peak in the third year, and fall in the fourth and final year.

Hirsch’s theory is based on the idea that, because the first half of a new president’s term is spent shifting priorities and fulfilling campaign promises, it’s the weakest for stocks. But the market improves during the second half when the president boosts the economy and shoots for reelection.

While patterns in historical data can help us predict what’s to come, It’s important to remember that past performance in the stock market does not guarantee future results. Some historical stock market data may corroborate the Presidential Election Cycle Theory, while other data may simply be coincidental.

Does Political Party Matter?

If a new U.S. president doesn’t affect the stock market as much as we think it does, what about political party? Is the stock market impacted when Democrats or Republicans hold the White House?

It’s a fair assumption. The National Small Business Association (NSBA) found that 87% of Republicans say their party is more representative of small business than Democrats at 67%. That may suggest that a Republican president is better for the stock market.

However, that’s not really the case. A Ned Davis Research study from November 2019 found that the market tends to rally during an election year after a winner is determined, regardless of political party. You can see in this chart how U.S. equities have trended upward for the past 100 years no matter who or which party was in power.

Factors With a Larger Impact on the Stock Market

Even if the U.S. presidential election has some sort of relationship with stock market performance, it doesn’t mean that it’s the only factor with influence. An increasingly global economy means that the president of one country, even a big player like the United States, doesn’t hold as much power over the market as we like to think.

What factors do influence markets in the U.S. and around the world? Natural disasters, for one thing. Fiscal and monetary policy. Political events, fluctuating interest rates, and supply and demand can cause the market to go up and down.

And of course, a global pandemic like COVID-19 will have a significant impact on markets around the world.

The Bottom Line

What do these ideas mean for your personal investment strategy? Remember that we’re not investing in presidents. We’re investing in businesses. A good investment strategy plays the long game; it shouldn’t change every four years, and it shouldn’t accommodate changes in government every four years.

It’s better to create a diversified strategy based on your values and long-term goals. Avoid the pitfalls of building a hasty strategy based on fear and greed, trying to “win” the market, or current events — like presidential elections.

At Guiding Wealth, we work with you to create a solid strategy that supports those values and goals. Together, we’ll build a strategy that stands the test of time and is designed for more than just one election cycle. Give us a call to see if Guiding Wealth is a good fit for you.