Last fall, I asked a 5th grade class via Twitter what they thought the best money advice a financial planner could give was. They sent back the following list:

-

Buy things that last

-

Separate needs from wants

-

Spend money on the things you will use

-

Spend money wisely

-

Don’t eat at restaurants, they are expensive

Pretty smart kids, those fifth-graders! This week, I got to meet those students in person when I visited their class. The ideas we talked about were simple, but the concepts hold true whether you are a grade school student or well into adult life.

Earning (and Spending) Money

We began our discussion by finding out how the students earned their money. One student said she got money for helping with her siblings, another said he does chores. One enterprising youngster said he helps his grandpa sell horses!

When asked what they spent their money on, one girl summed it up best: “whatever I want!” Oh, to be a fifth-grader again!

The teacher had asked that I incorporate some math into my discussion with his class, and there’s no doubt that a financial planner’s favorite math is compound interest!

One of my favorite quotes says, “He who understands compound interest, earns it, he who doesn’t, pays it.”

Interest was a new concept to this class. I began by explaining mortgages. It made sense to the students that a bank would want something in return for loaning money to someone to use for buying a house or a car. It was a logical conclusion then, that if they were going to invest money, they would expect something back (interest), just like the bank would.

Planning for Retirement at Age 10

Next I asked them how much money they would have at age 55 if they saved $50 per month starting now (at age 11).

They determined they would have $26,400 ($50 x 12 months = $600 x 44 years = $26,400); a tremendous amount of money to these eleven-year-olds!

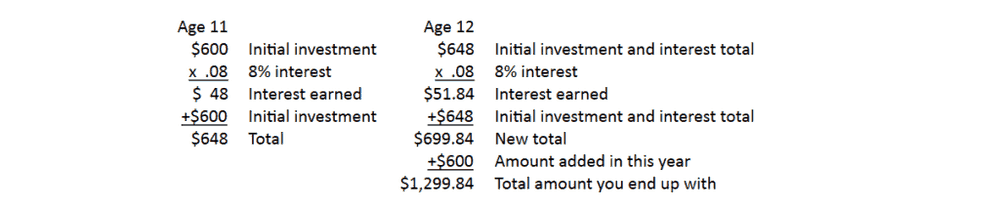

We started working through the math, calculating how much they would have if they invested the $50 per month, every month, for one year and earned an 8% interest rate. The math problem looked like this:The idea that you could make almost $100 in two years without doing any extra work was exciting to these students. However, they still couldn’t see just how impressive compound interest was. So I tried to show them the bigger picture by demonstrating how much the investment and interest added up to over the years.

The class guessed that with compound interest they would have a number close to double what they would have saved at $26,400. But we did the math, finding out that if they would invest $50 per month (or $600/year) at 8%, they would have $214,169 at age 55, over eight times as much money as they would have saved by putting the money in a checking account.

Of course, when you invest in real life, the return doesn’t happen in the same linear way we figured out the math above. As we all know, actual investing is much more volatile and goes up and down by the minute. But the basic principle remains the same: investing and earning compound interest over the long term will multiply your initial investment exponentially. It was a dramatic illustration to fifth-graders, but can be applicable to whatever stage of life a person is in.

I enjoyed my personal finance lesson with those bright and earnest kids, but I’ll leave it up to someone else to teach the lesson about the hazards of spending money “however I want”.