How will the 2018 tax bill affect you? For most, taxes will go down. How much is based largely on your specific situation.

The following are things that you can do to help yourself in light of the 2018 tax bill.

1. Take any deductions that you can in 2017. This would include any charitable contributions or paying your 2018 property tax in 2017.

This is advantageous for two reasons: first, most people are in a higher tax bracket this year than they will be next year; and secondly, it will be harder for most people to itemize their deductions in future years.

2. Continue to take advantage of tax shelters that are offered through your employer like your 401(k) and any deferred compensation plans.

3. If you are in a lower tax bracket, take advantage of Roth IRAs and accounts that you can put money in after-tax now.

Changes in Tax Brackets in 2018

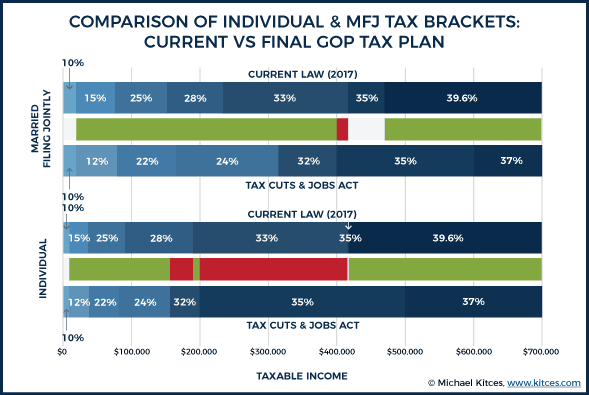

Below is a chart which shows the changes in the tax rates for all income levels. The green bars indicate a positive change (lower taxes) and the red bar indicates a negative change (higher taxes). From the graph, individual taxpayers making between $200,000 and $400,000 will see their tax rate increase, while the majority will see their tax rates decrease.

Increased standard deduction in 2018

One of President Trump’s original stated goals on his tax reform was to simplify the tax code. One area this was achieved was in eliminating personal exemptions and increasing the standard deductions.

In the past, the individual standard deduction was $6,350 and the personal exemption was $4,050, totaling an overall deduction of $10,400. The new, higher standard deduction is now $12,000, meaning if you didn’t itemize your taxes, you would be slightly better off.

The thing to remember is, you were able to deduct various items that exceeded the $6,350 standard deduction and now you’ll only be able to deduct items that exceed the $12,000, which will preclude many from being able to deduct specific items.

For couples that are married filing jointly, the new standard deduction is $24,000 versus the old standard deduction of $12,700, plus the $4,050 personal exemption for each person. The total deduction for a couple then would be $20,800.

The total benefit from the standard deduction for children goes away as there’s an additional $4,050 deduction for every child. The tax bill accounts for this by expanding the child tax credit from $1,000 to $2,000 per child.

Other Notable Changes for Taxes in 2018

-

Property, state and local income taxes were limited to $10,000 in total combined deductions. For states with high income taxes or people whose property tax exceed $10,000, this will limit many of the most common deductions seen.

-

529 plans can now be used for private elementary and secondary school. There is a $10,000/year limit on how much can be pulled out for each child per year.

-

The health insurance individual mandate is repealed. Individuals and families will no longer be penalized for not having health insurance going forward. The intention behind requiring everyone to have health insurance was to increase the risk pool therefore leveling out the risk. While it is yet to be seen whether people will drop their health insurance because they don’t have to have it, it is known that many people have dropped health insurance because it was too expensive to maintain.

-

Changes in deferred compensation. The new tax bill takes away the biggest benefit of deferred compensation, which is allowing your compensation to be deferred until you want to receive the money as income. The new law states deferred compensation will be taxed when there is “no substantial risk of forfeiture,” which many are interpreting as vesting. We expect to see changes to executive benefits in the coming year, specifically as it relates to deferred compensation.

-

Increase in child tax credit. The child tax credit increased from $1,000 to $2,000 with $1,400 refundable. Also, the phase-out for claiming the child tax credit was increased to $400,000, which is a dramatic increase from the old $110,000 for married couples.

If you have questions about how these tax changes will affect you, and you’re interested in seeking financial planning advice, contact Hannah and the team at Guiding Wealth.